ADVERTORIAL

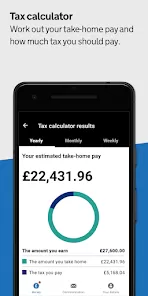

The HMRC App, also known as the Her Majesty's Revenue and Customs App, is a useful tool designed for UK residents who want to easily and efficiently handle their tax information. This mobile app enables users to perform a variety of tasks directly from their smartphones, eliminating the need for paperwork or waiting in long queues.

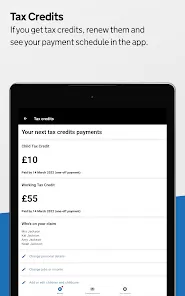

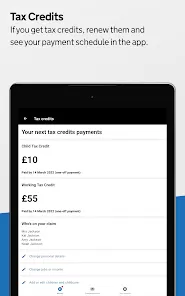

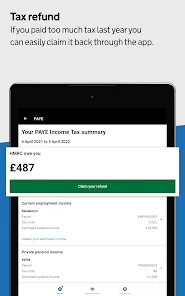

With the HMRC App, individuals can view their tax code, update personal information, access details about tax credit payments, and even renew their tax claim for the year. Additionally, it provides a secure method to access personal tax accounts and Self Assessment tax returns.

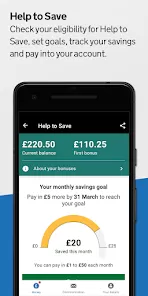

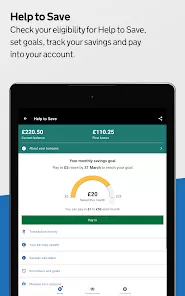

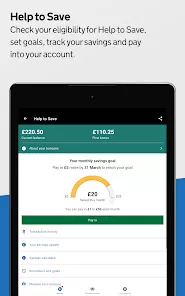

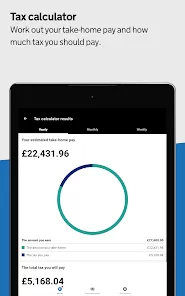

Serving as a central hub for all tax-related requirements, the application brings the services of HMRC to users' fingertips. Whether experienced in tax matters or new to the process, the HMRC App streamlines the often overwhelming task of tax management. The HMRC App offers a variety of features aimed at simplifying the process of managing your taxes.

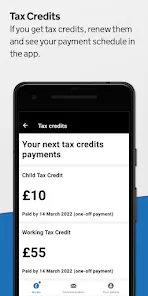

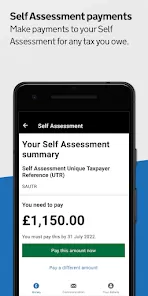

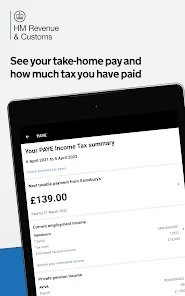

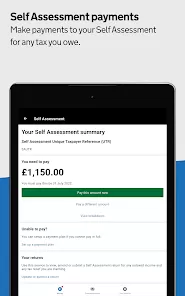

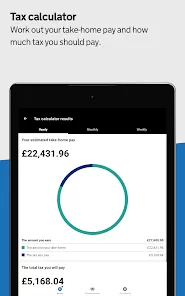

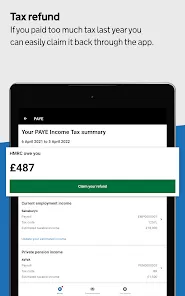

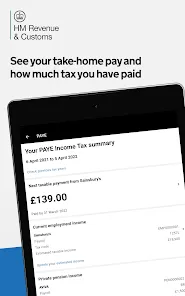

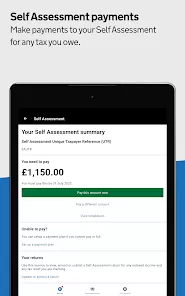

These features include accessing your personal tax account securely to view details, tax code, and estimates. Additionally, you can submit your Self Assessment tax return directly through the app. Users can also check the status of their tax credit payments and renew their claim for the tax year. Updating personal details is easy and helps ensure records are current.

The app provides information on the latest PAYE Coding Notice and its implications. There is also a help and support section with FAQs to assist users with tax-related inquiries. Overall, these features make the HMRC App an essential tool for efficiently managing taxes.

The strengths and weaknesses of the HMRC App, like any other application, should be considered.

- Accessibility: The app allows users to access their personal tax account on the go.

- Convenience: Users can efficiently update personal information and review tax estimates, making tax management easier.

- Timely updates: Using the HMRC App ensures users are informed about their tax credit payments, preventing any missed updates.

- Assistance: The app includes a strong help and support section that addresses many tax-related questions.

- Limited features: Some advanced features found on HMRC's web platform are not available on the app.

- Usability issues: The app's interface may be perceived as complex by some users, potentially affecting their experience.

- System Glitches: Users have experienced occasional system glitches and login problems, causing frustration.

- Data Consumption: The app may consume a significant amount of mobile data.

These advantages and disadvantages provide a balanced view of the HMRC App's functionality, assisting users in determining if it suits their tax management needs.

The HMRC App offers a range of services to help with tax management, including access to Personal Tax Account for securely viewing personal tax details. Users can also submit Self Assessment tax returns, monitor tax credit payment status, easily renew claims, update personal details, and understand PAYE Notice details directly through the app.

Help and support is also available for users to reach out for assistance and find answers to common tax-related questions. All of these features work together to make tax management more convenient and efficient.

Utilizing the HMRC App is an easy and uncomplicated process. Below is a step-by-step manual to assist you in navigating through it:

- Download the App: The HMRC App can be found in the app store on your smartphone. When located, proceed to download and install it on your device.

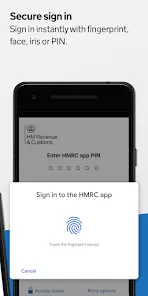

- Establish an Account: For new users, it is necessary to create an HMRC account. For existing users, simply log in using your credentials.

- Navigate the Dashboard: Upon logging in, you will be directed to the app's dashboard. Here, you will have access to various options such as 'Personal tax', 'Self Assessment', 'Tax credits', and 'Help and Support'.

- Access Personal Tax Account: To view your personal tax information, choose 'Personal tax'. This section allows you to check your tax code, view estimates, and update personal information.

- Submit Self-Assessment: If you need to file a Self-Assessment tax return, select 'Self Assessment' from the dashboard and follow the instructions.

- Verify Tax Credits: Select 'Tax credits' to review your payment status or renew your claims.

- Utilize Help and Support: For any inquiries, visit 'Help and Support'. You can find answers to common tax-related questions here.

It is important to remember that managing taxes does not have to be complicated, and the HMRC App is available to demonstrate this.

0

0